LMTdc’s financial model is rooted in leveraging blockchain and AI technologies to acquire, optimize, and scale small-to-medium-sized e-commerce businesses. The company’s strategy is to create a robust, diversified portfolio of e-commerce ventures, aiming for rapid expansion and significant profitability. Below is an in-depth look at the financial projections and current business landscape for LMTdc.

Current Business Performance

As of Q3 2024, LMTdc manages 40 e-commerce businesses across diverse sectors, including fashion, consumer electronics, and specialized services. These businesses are primarily in high-growth markets like London, Dubai, and North America. Here are some insights into the current business performance:

Profitability: LMTdc’s existing e-commerce businesses average $1,200 in monthly profit per business. This profitability stems from data-driven strategies, where customer acquisition, product selection, and operational efficiency are optimized using AI algorithms. LMTdc invests in businesses with high growth potential and low operating costs, which are further optimized through its proprietary sales and marketing strategies.

Market Niches: The portfolio focuses on sectors with recurring revenue models, such as subscription-based services, niche fashion brands, and digital products. These sectors are selected due to their higher lifetime customer value (CLV) and lower customer acquisition costs (CAC), enabling faster profitability.

Operational Model: Each business within the portfolio is operated by LMTdc’s internal management teams, ensuring tight control over decision-making, product development, and marketing. This internal management structure allows LMTdc to keep operational costs low and avoid the risks of external partners underperforming.

E-Commerce Growth Strategy (2024–2029)

LMTdc’s roadmap is based on aggressive scaling, doubling the number of e-commerce businesses managed annually. The company aims to reach 1,280 e-commerce businesses by 2029.

Business Acquisition and Optimization:

- LMTdc’s AI algorithms are used to identify undervalued e-commerce businesses with strong fundamentals and growth potential. The proprietary platform FLIPERCE plays a critical role in scouting, acquiring, and selling profitable ventures.

- After acquisition, each business undergoes rigorous operational optimization to increase profitability through AI-driven customer insights, enhanced advertising strategies (such as better-targeted ads on social media and Google), and personalized user experiences.

Investment Sectors:

- 90% of the portfolio will consist of digital services or products, including London-based decorating services, cost-effective streaming service subscriptions, and niche plumbing solutions in Kentucky, America. This focus on digital products and services helps maintain high gross margins and minimizes the risks associated with inventory management and logistics.

Risk Mitigation:

- LMTdc minimizes market risks by diversifying across multiple e-commerce verticals and applying AI models to predict market demand. LMTdc’s Volatility Buffer Algorithm ensures that reserve levels are adjusted in real-time to absorb market price shocks. The Liquidity Pool Stabilizer also ensures smooth liquidity for token holders, protecting against price swings

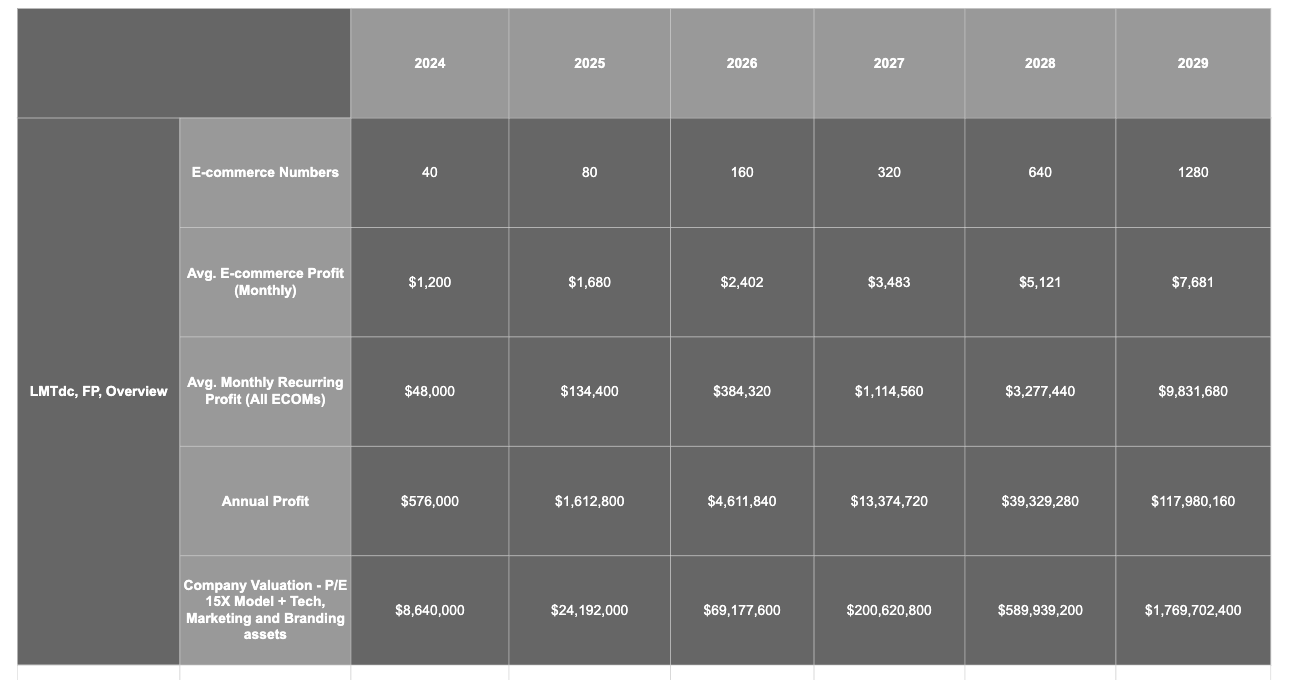

Financial Projections (2024–2029)

E-Commerce Portfolio Growth:

| Year | Number of E-commerce Businesses | Average Monthly Profit per Business | Total Monthly Profit |

|---|---|---|---|

| 2024 | 40 | $1,200 | $48,000 |

| 2025 | 80 | $1,680 | $134,400 |

| 2026 | 160 | $2,402 | $384,384 |

| 2027 | 320 | $3,483 | $1,114,714 |

| 2028 | 640 | $5,121 | $3,277,258 |

| 2029 | 1,280 | $7,681 | $9,831,774 |

This growth projection shows that LMTdc will achieve substantial revenue increases, driven by both the increase in the number of businesses under management and the growth in average profit per business. The average annual profit growth rate per e-commerce business is projected to accelerate from 40% to 50% by 2029, reflecting the company’s ability to scale efficiently.

Annual Profit:

- 2024: $576,000

- 2025: $1.61 million

- 2026: $4.61 million

- 2027: $13.38 million

- 2028: $39.33 million

- 2029: $117.98 million

These projections highlight an exponential growth trajectory for LMTdc, largely fueled by its capacity to quickly scale profitable e-commerce ventures.

Company Valuation:

- 2024: $8.64 million

- 2025: $24.19 million

- 2026: $69.19 million

- 2027: $200.65 million

- 2028: $589.91 million

- 2029: $1.77 billion

By 2029, LMTdc is projected to reach a valuation of over $1.77 billion, reflecting its dominant market position in the e-commerce space.

Revenue Streams and Business Model

LMTdc’s revenue model is diverse and includes the following streams:

- E-commerce Profits: The primary revenue comes from the profits generated by the 1,280 e-commerce businesses. These businesses are optimized to generate recurring profits through efficient customer acquisition strategies, high customer lifetime value, and targeted marketing.

- E-commerce Flipping via FLIPERCE: LMTdc acquires underperforming or undervalued e-commerce ventures, optimizes them, and then sells them at a higher valuation through the FLIPERCE platform. This model adds an additional layer of profitability.

Conclusion:

The financial projections for LMTdc underscore the company’s aggressive yet calculated growth strategy, supported by its existing portfolio of successful e-commerce ventures. Through continued expansion, optimization of profits, and integration of cutting-edge technology, LMTdc is well-positioned to become a leader in the global e-commerce market.

Comments

Very good project m really happy….

Dear all,

LMTdc Financial project: in details is one of the largest financial project in the world which is open to reliability, confidentiality and profitability.

Am 100% deeply in support with the project and I which all the best of this.

Thanks

Nice project