The LMTdc (Limitless Digital Corp) pre-sale round is an exciting opportunity for early investors to get involved in a project that’s focused on long-term growth and sustainability in the e-commerce sector. We aim to raise $2 million during this phase to fund the acquisition and scaling of profitable e-commerce businesses. In addition to discounted token prices, investors can expect to receive quarterly dividends based on the performance of our e-commerce portfolio, with the first payout happening in USDT (ERC-20) at the end of Q1 2025.

This document outlines the full structure of the pre-sale, our e-commerce investment metrics, fund allocation, risk management strategies, and our long-term vision for growth.

I. Pre-Sale Structure: Offering and Tokenomics

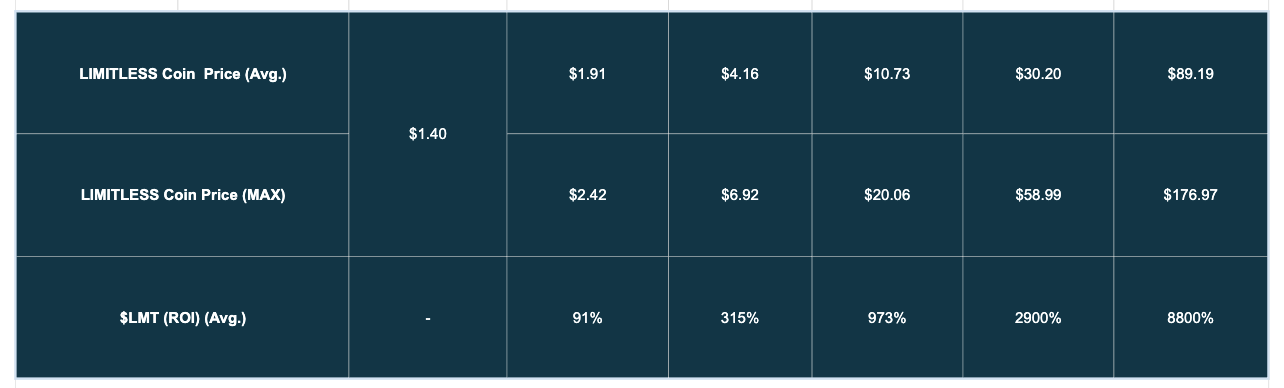

Our pre-sale is divided into three key stages, providing investors with access to Limitless Coin ($LMTdc) at varying levels of discount and vesting terms. Each stage is tailored to appeal to different types of investors, from retail participants to large-scale institutional investors.

Key Pre-Sale Details:

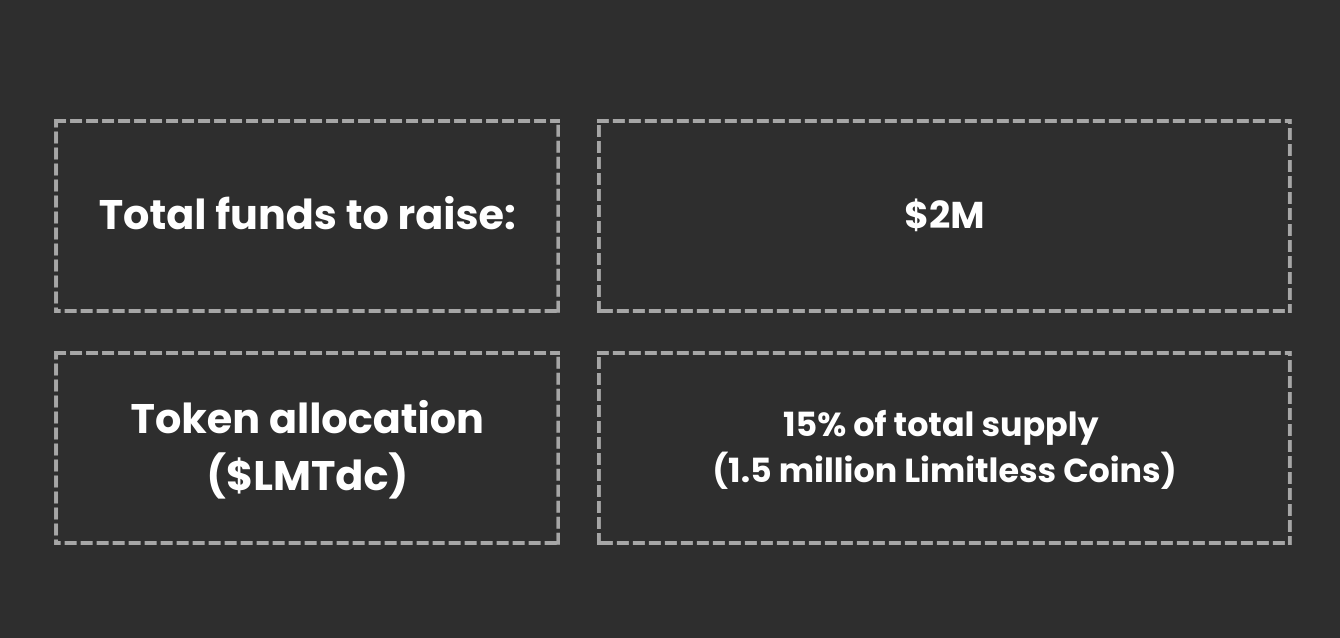

- Total funds to raise: $2 million.

- Token allocation: 15% of total supply (1.5 million Limitless Coins).

- Token price: Discounted at varying levels based on the size of the investment.

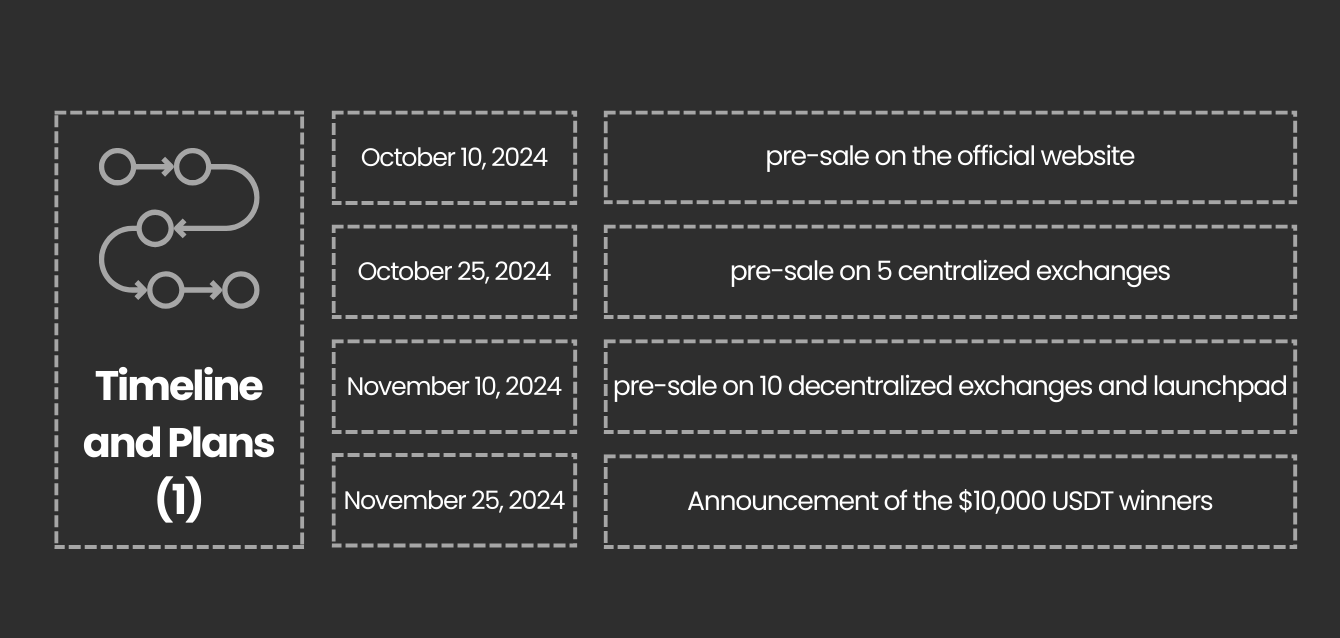

- Pre-sale duration: Starting October 10th, 2024, and running until January 2025 (depending on the stage).

Discount structure:

- $0.425 – $0.325 per token based on investment size (up to 35% discount compared to the ICO price of $1.40).

Vesting terms:

- Tokens will be locked for a period ranging from 2 months to 2 years, depending on the size of the investment. This ensures price stability and encourages long-term participation.

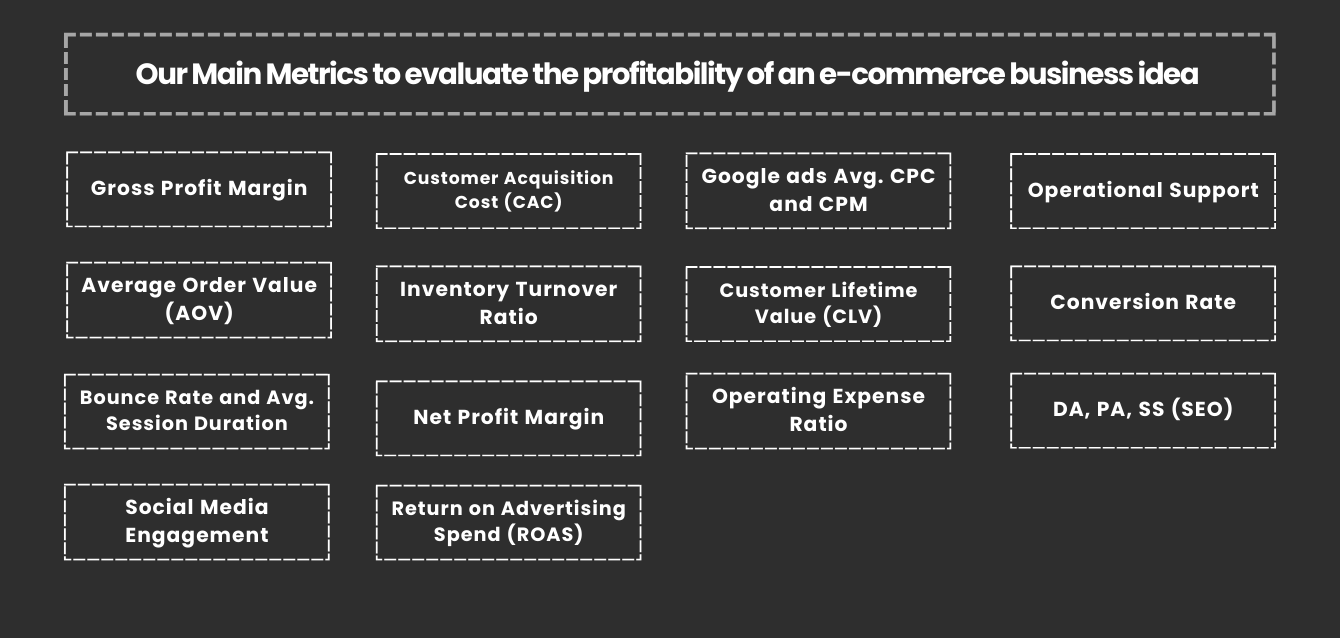

II. How We Select E-Commerce Investments: Key Metrics

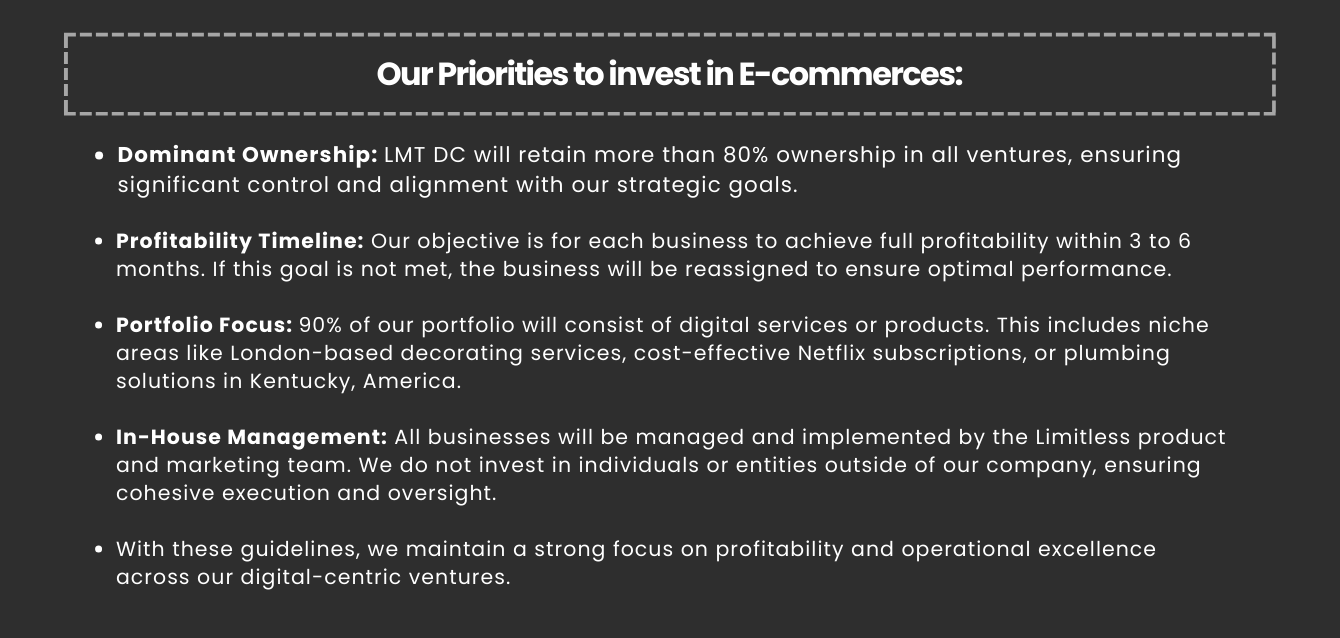

At LMTdc, we’re not just buying any e-commerce business. We use a data-driven approach to evaluate every potential acquisition, ensuring that we invest in businesses with high-growth potential and profitability. Our main metrics for selecting e-commerce investments include:

1. Customer Acquisition Cost (CAC)

This metric helps us understand how much it costs to acquire each customer. We focus on businesses with low CAC, which indicates that they have effective marketing strategies and a solid brand presence. A lower CAC typically means a higher return on investment (ROI) in the long run.

2. Return on Advertising Spend (ROAS)

ROAS measures the efficiency of marketing spend by comparing revenue generated to the amount spent on advertising. We look for businesses with a high ROAS, meaning they get more value out of their marketing efforts. A strong ROAS is essential for scaling businesses profitably.

3. Gross Profit Margin

Gross profit margin is a key indicator of how much a company makes after accounting for the cost of goods sold (COGS). We prioritize businesses with high profit margins to ensure that even small increases in sales lead to significant profit growth.

4. Customer Lifetime Value (CLV)

The CLV metric tells us how much revenue a business can expect to generate from each customer over time. Businesses with a high CLV often have strong customer loyalty, repeat purchases, and effective upselling strategies. This allows us to plan for long-term profitability.

5. Market Size and Growth Potential

We target e-commerce sectors with large market opportunities, such as health & wellness, pet products, education, and digital products. These sectors offer significant growth potential, which will contribute to our overall revenue projections.

6. Scalability

We assess how easy it will be to scale the business with additional marketing, operational improvements, and geographic expansion. Businesses with scalable operations are more likely to generate higher profits when given additional resources.

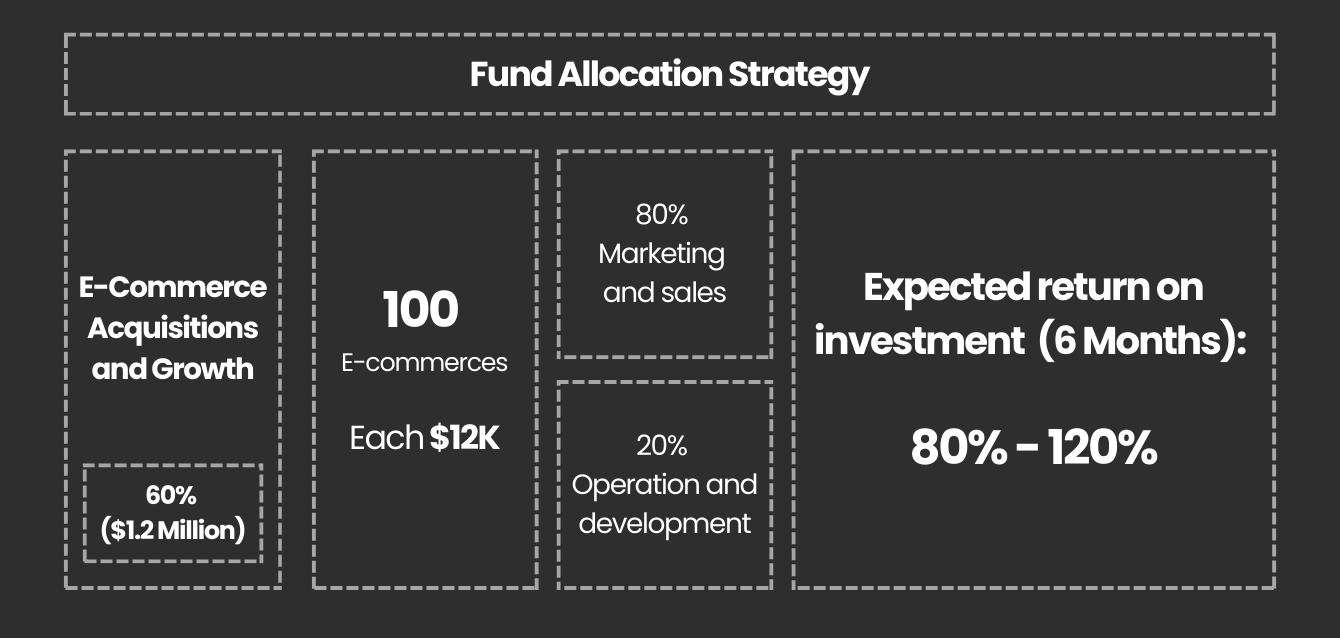

III. Fund Allocation Strategy: Where Will the Pre-Sale Funds Go?

The $2 million raised during the pre-sale will be strategically allocated to ensure that every dollar contributes to acquiring, optimizing, and scaling profitable e-commerce businesses. Here’s how the funds will be distributed:

1. E-Commerce Acquisitions and Growth – 60% ($1.2 Million)

The majority of the funds will go toward acquiring high-potential e-commerce businesses that fit our key investment criteria. Once acquired, we will focus on optimizing and scaling these businesses to increase profitability.

2. Platform Development and Technology – 20% ($400K)

To effectively manage and scale our portfolio of e-commerce ventures, we are investing in a centralized management platform. This platform will integrate AI-driven tools to help us track Customer Acquisition Costs (CAC), Return on Advertising Spend (ROAS), and other key performance indicators in real time.

3. Marketing and Community Building – 10% ($200K)

We will allocate a portion of the funds to marketing campaigns aimed at building a strong community around Limitless Coin. This includes digital marketing, social media engagement, and influencer partnerships to spread awareness about LMTdc and its growing portfolio.

4. Liquidity Pool and Exchange Listings – 5% ($100K)

We will ensure that Limitless Coin has sufficient liquidity by creating liquidity pools on decentralized exchanges (DEXs) and covering listing fees for centralized exchanges (CEXs) like Gate.io, P2B, and Coinstore.

5. Operational Costs and Legal Compliance – 5% ($100K)

Finally, a portion of the funds will cover operational expenses, including legal fees to ensure compliance with SEC and international regulations, and the cost of running the business.

IV. First Quarter Dividends in USDT ERC-20

As part of our commitment to delivering returns to investors, LMTdc will distribute quarterly dividends based on the profits generated from our e-commerce portfolio. The first dividend payment will be made in USDT (ERC-20) at the end of Q1 2025.

How Dividends Work:

- Dividends will be paid proportionally to the amount of Limitless Coin held by each investor.

- Payouts will be made in USDT (ERC-20), a stablecoin that provides stability and liquidity to our investors.

- The dividend payouts will reflect the net profits generated from our e-commerce businesses during the first quarter, after accounting for operational expenses.

By paying dividends in USDT, we provide investors with a stable and reliable return, independent of Limitless Coin’s price fluctuations.

V. Vision for Growth: Where We’re Headed

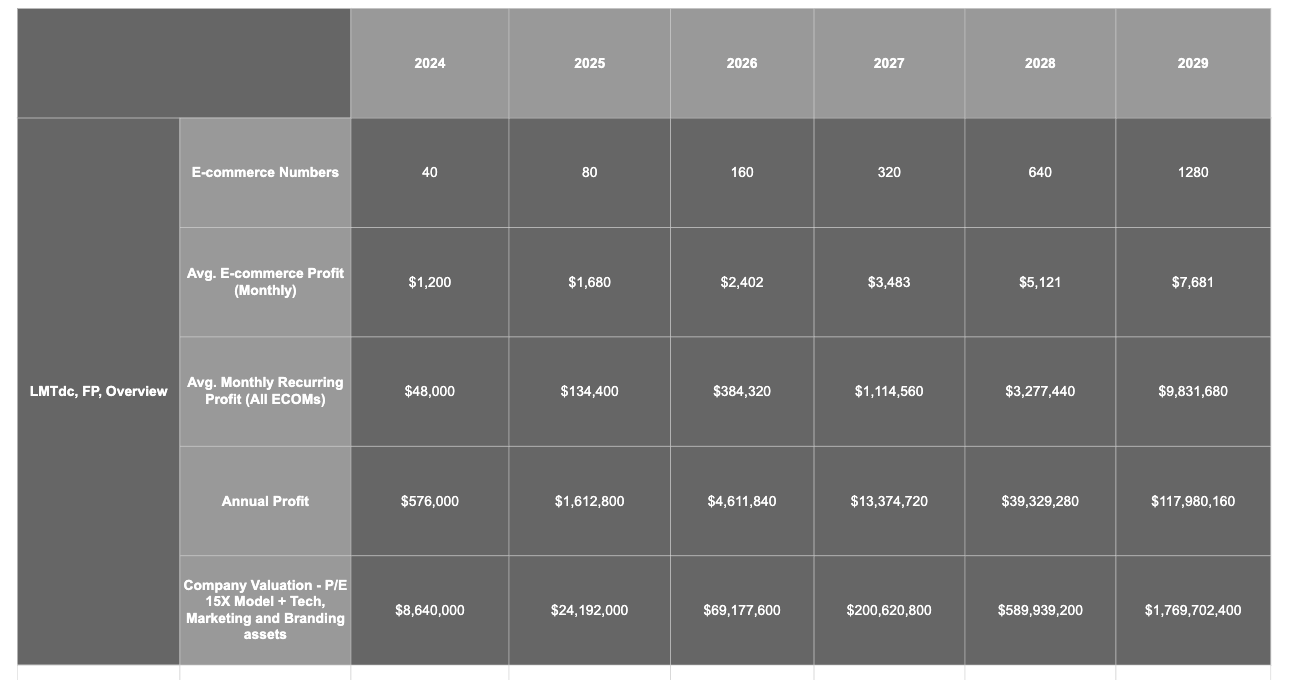

Our vision is clear: by 2029, we aim to manage over 1,000 thriving e-commerce businesses that generate consistent profits and provide strong returns to our investors.

What Success Looks Like for LMTdc:

- Quarterly Dividends: As our portfolio of e-commerce businesses grows, so will the dividends we pay to our investors. We aim to consistently increase dividend payouts as we scale and acquire more profitable ventures.

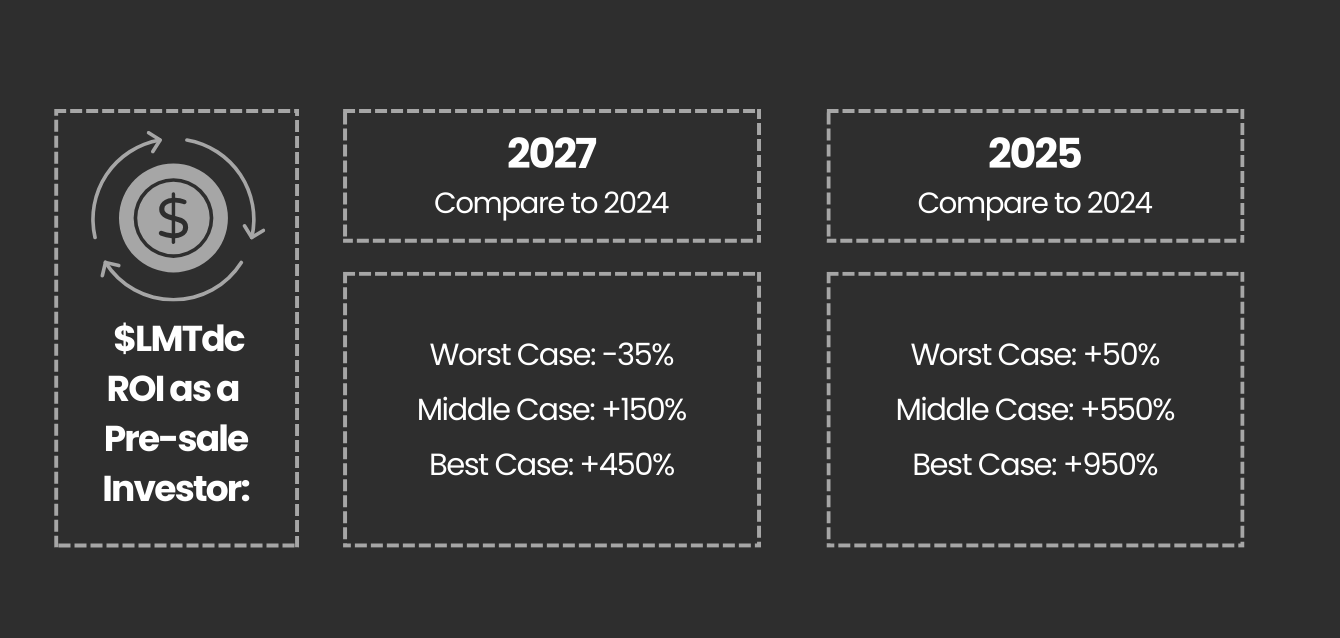

- Token Appreciation: As we continue to grow and expand our portfolio, we expect the value of Limitless Coin to rise, offering investors significant appreciation in addition to quarterly dividends.

- Global Reach: We plan to expand our portfolio to include businesses from multiple markets around the world, giving us access to diverse revenue streams and reducing regional risks.

VI. Risks of Investment and How We Manage Them

Like any investment, there are inherent risks associated with buying Limitless Coin and participating in our e-commerce ventures. However, we have built a comprehensive risk management strategy to minimize these risks and protect our investors.

Key Risks:

Market Volatility

- The cryptocurrency market is known for its volatility, which can lead to price fluctuations for Limitless Coin. We mitigate this by offering quarterly dividends in USDT, which provides stable, predictable returns regardless of token price movements.

Business Acquisition Risk

- Not all e-commerce businesses may perform as expected after acquisition. To manage this risk, we use a rigorous selection process based on data-driven metrics such as ROAS, CLV, and profit margins. This ensures we only invest in businesses with strong fundamentals.

Regulatory Risk

- Cryptocurrencies are subject to changing regulations, especially in countries like the U.S. and Europe. We have a dedicated legal team that monitors regulatory developments and ensures full compliance with the laws in all jurisdictions where we operate.

Liquidity Risk

- Low liquidity could affect the ability to trade Limitless Coin effectively. To prevent this, we will allocate 5% of the pre-sale funds to liquidity pools on both centralized and decentralized exchanges, ensuring smooth trading and price stability.

Conclusion: A Smart Investment for the Long-Term

The LMTdc pre-sale round is a rare opportunity to invest in a project with real-world utility and strong growth potential. By investing in profitable e-commerce businesses, we aim to provide consistent returns to our investors through quarterly dividends and token appreciation.

With a solid strategy for managing risks and a clear vision for scaling our e-commerce ventures, LMTdc is poised to become a major player in the digital investment and e-commerce space.

By participating in the pre-sale, you’re not just buying a token—you’re investing in a company that’s building the future of e-commerce and offering real, tangible value to its investors.

Comments

Glad to be part of this project! Looking forward to the launch👍👍

درود و سپاس آینده روشن و پر سودی میبینم ،،👍

I’m interested

Hello, I am Mohsen Sharifian, I have read your company’s investment strategy and I have a question, will the projects that are approved remain under the management of your company?

Best regards

Very nice 👍

How to buy LMTdc?